1. Tax incentives when it is confirmed that the enterprise has software production activities

Based on:

- Law on Investment No. 67/2014/QH13;

- Circular 96/2015/TT-BTC Circular guiding corporate income tax in Decree 12/2015/ND-CP detailing the implementation of the Law amending and supplementing several articles of the Law on Taxation and Taxation. amending and supplementing several articles of Circular 78/2014/TT-BTC, Circular 119/2014/TT-BTC, and Circular 151/2014/TT-BTC issued by the Minister of Finance;

- Circular No. 78/2014/TT-BTC Circular guiding the implementation of Decree No. 218/2013/ND-CP dated December 26, 2013 of the Government providing and guiding the implementation of the Law on Corporate Income Tax.

As a subject of investment incentives, enterprises engaged in the production of software products will enjoy some of the following tax incentives:

2. Procedures for certifying that an enterprise has software product manufacturing activities

Based on:

– Circular 20/2021/TT-BTTTT dated December 3, 2021 of the Ministry of Information and Communications amending and supplementing Circular No. 09/2013/TT/BTTTT dated April 8, 2013 of the Minister of Information and Communications promulgate the list of software and hardware products and electronics.

– Circular 13/2020/TT/BTTTT of the Ministry of Information and Communications dated July 3, 2020 on Regulations on certification of software product manufacturing activities that meet the process.

– Circular 78/2014/TT-BTC and Circular 78/2013/TT-BTC stipulate procedures for enjoying corporate income tax incentives.

Ms. Dang Thi Huong Thao (Head of Corporate Services & Compliance) said:

a) According to regulations, enterprises themselves determine whether their activities are subject to management agencies, organizations, and enterprises related to software product production activities according to the Circular of the Ministry of Information and Communications and prove with the Tax Office when there is an inspection.

b) Complete the documents of the Ministry of Information and Communications and the Ministry of Finance. After being approved by the state agency, enterprises begin to enjoy incentives.

c) Particularly in Da Nang, the Department of Information and Communications cooperates with the Da Nang Tax Agency to support the appraisal and certification of software manufacturing enterprises.

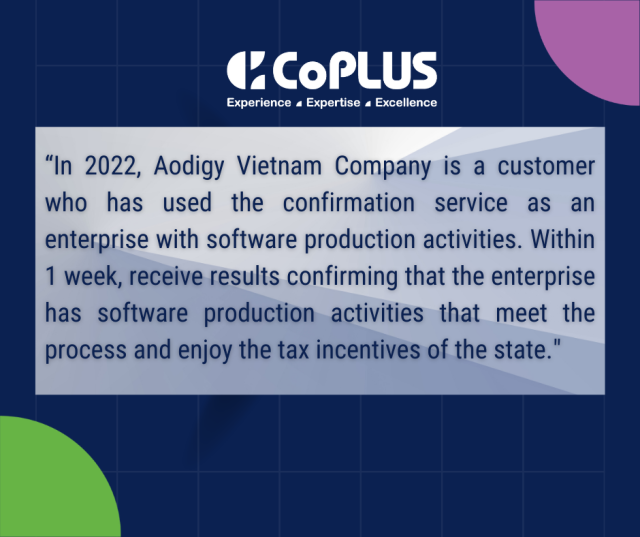

3. CoPLUS will carry out procedures to confirm that the enterprise has software production activities within 1 week.

Step 1: The written request to certify that the enterprise has software production activities, including supporting documents; business registration certificate

Step 2: Explain legal regulations to customers

Step 3: Coordinate to collect documents to prove the software business

Step 4: Submit your application

Step 5: Get the result

If you want to receive a FREE consultation and use CoPLUS’S SOFTWARE PRODUCTION PRODUCTION ACTIVITIES BUSINESS CONFIRMATION SERVICE PLEASE CONTACT:

If you want to receive a FREE consultation and use CoPLUS’S SOFTWARE PRODUCTION PRODUCTION ACTIVITIES BUSINESS CONFIRMATION SERVICE PLEASE CONTACT:

Add: Lot B16 Hoang Quoc Viet Street, An Cuu New Township , An Dong Ward, Hue City, Thua Thien Hue province

3rd Floor – No. 16, 18 An Nhon 3, An Hai Bac Ward, Son Tra District, Da Nang City

Email: info@coplus.com.vn

Hotline: 0963833101