The Law on Tax Administration officially took effect on July 1, 2020. Accordingly, agencies, organizations and individuals are required to use e-invoices from July 1, 2022.

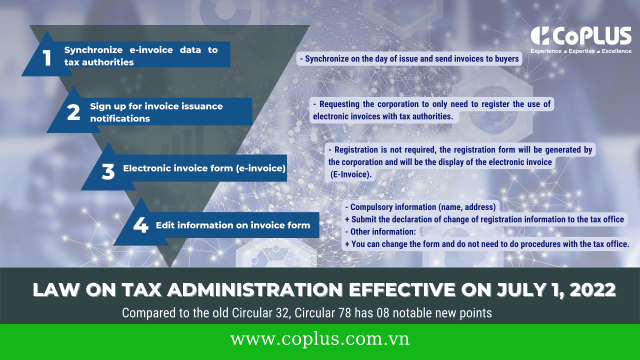

Circular 78/2021/BTC/September 17, 2021. From July 1, 2022, all businesses paying tax according to the declaration method must use electronic invoices. Compared to the old Circular 32, Circular 78 has 08 notable new points:

-

Mục lục

- Synchronize e-invoice data to tax authorities

- Sign up for invoice issuance notifications

- Electronic invoice form (e-invoice)

- Edit information on invoice form

- Digital signature

- Process of handling incorrect invoices that have been issued

- Regulations on explanation if tax authorities review invoice data and detect suspected errors

- No longer BC26 report regulation

Synchronize e-invoice data to tax authorities

– Synchronize on the day of issue and send invoices to buyers

-

Sign up for invoice issuance notifications

– Requesting the corporation to only need to register the use of electronic invoices with tax authorities. Use the prescribed auto-referencing symbol and denominator. The invoice number sequence will be reset every year from 1 to 99,999. 999.

-

Electronic invoice form (e-invoice)

– Registration is not required, the registration form will be generated by the corporation and will be the display of the electronic invoice (E-Invoice).

-

Edit information on invoice form

– Compulsory information (name, address)

+ Submit the declaration of change of registration information to the tax office

– Other information:

+ You can change the form and do not need to do procedures with the tax office

-

Digital signature

– Corporations need to register with the tax authority what digital signature will be signed on the declaration of registration of using e-invoices.

– In case of renewal, The changing of digital signature, must be notified to the tax authority by a declaration of changing of registration information.

-

Process of handling incorrect invoices that have been issued

The user can completely replace or adjust the invoice, regardless of whether the tax has been declared or not.

– Invoice has not been sent to the buyer:

+ Cancel the incorrect invoice

+ Send notice of incorrect invoices to the tax office

+ Create a new invoice

– Invoice sent to buyer with wrong name or address of buyer:

+ Send notice of incorrect invoices to the tax office

+ Inform the buyer of the incorrect invoice and do not need to re-invoice.

– Invoices sent to the buyer, with errors in other information or the buyer’s address, there will be 2 handling methods:

+ Make a replacement invoice

+ Make adjustment Invoice

– Send error notices to tax authorities

– Make a Minute Of Agreement that clearly shows the error (if the two parties agree to make minutes)

-

Regulations on explanation if tax authorities review invoice data and detect suspected errors

– Upon receiving the notice of the tax authority, Corporations will need to send a notice of the incorrect invoice to the tax office.

-

No longer BC26 report regulation

Above are 08 notable points about using e-invoices that CoPLUS brings to customers and businesses. If there is a need for e-invoice and tax accounting services, please contact CoPLUS.

CoPLUS is a tax agent highly appreciated by local authorities for our experience and expertise. 06 years of accompanying businesses CoPLUS has provided and supported legal, tax accounting for more than 200 businesses in 23 countries with more than 100 projects.

Address: B16, Hoang Quoc Viet street, An Dong Ward, Hue City

Email: info@coplus.com.vn

Hotline: 0963833101